Revolutionizing Finance and Accounting Using The Power of RPA

In the realm of finance and accounting, efficiency, accuracy, and compliance are paramount. Manual, repetitive tasks can bog down operations and hinder productivity, leaving little time for strategic initiatives. Enter Robotic Process Automation (RPA), a transformative technology that promises to revolutionize finance and accounting processes. In this blog, we'll explore how RPA is streamlining finance and accounting processes, driving efficiency, and enabling organizations to thrive in today's dynamic business landscape.

Automating Routine Tasks

Finance and accounting departments are often inundated with routine, rule-based tasks that are ripe for automation. Tasks such as data entry, invoice processing, reconciliation, and report generation can be time-consuming and error-prone when performed manually. RPA bots can automate these tasks with speed and accuracy, freeing up finance professionals to focus on higher-value activities such as financial analysis, forecasting, and strategic planning.

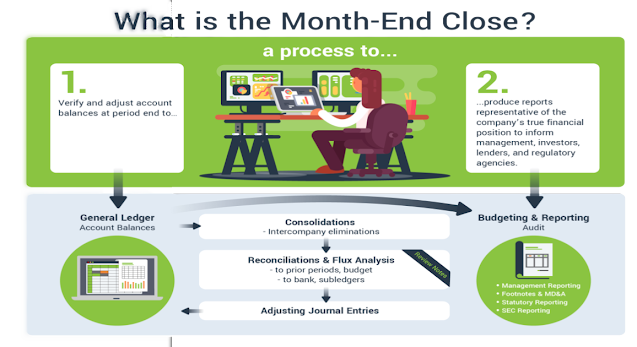

The month-end close process is a critical yet labor-intensive task for finance teams, requiring meticulous attention to detail and tight deadlines. RPA can significantly accelerate the month-end close process by automating repetitive tasks such as journal entry posting, account reconciliation, and variance analysis. By automating these tasks, organizations can shorten cycle times, reduce errors, and ensure timely and accurate financial reporting.

Enhancing Accounts Payable and Receivable Processes

Accounts payable and receivable processes are ripe for optimization through RPA. RPA bots can streamline invoice processing, automate payment approvals, and facilitate electronic invoice delivery and payment. By automating accounts payable and receivable processes, organizations can improve cash flow management, reduce late payments and penalties, and enhance vendor and customer relationships.

Ensuring Regulatory Compliance

Compliance with regulatory requirements is a top priority for finance and accounting departments, particularly in highly regulated industries such as banking, insurance, and healthcare. RPA plays a crucial role in ensuring compliance by automating compliance monitoring, reporting, and audit preparation tasks. RPA bots can perform regular audits, validate data integrity, and generate compliance reports, helping organizations mitigate risks and avoid costly penalties.

Enabling Data Analytics and Insights

RPA not only streamlines finance and accounting processes but also enables organizations to unlock valuable insights from their financial data. By automating data collection, cleansing, and analysis tasks, RPA bots can provide finance professionals with real-time visibility into key performance indicators, trends, and anomalies. This enables finance teams to make data-driven decisions, identify opportunities for cost savings and revenue growth, and drive business performance.

Conclusion

In conclusion, the adoption of RPA in finance and accounting is transforming how organizations manage their financial processes, driving efficiency, accuracy, and compliance. By automating routine tasks, accelerating month-end close processes, enhancing accounts payable and receivable processes, ensuring regulatory compliance, and enabling data analytics and insights, RPA is empowering finance and accounting departments to operate more effectively and strategically. As organizations continue to embrace digital transformation, RPA will play an increasingly vital role in shaping the future of finance and accounting, enabling organizations to thrive in today's fast-paced and competitive business environment.

Nice Blog👍

ReplyDeleteNice Blog. Good Explanation

ReplyDeleteGreat share 👍

ReplyDelete